Federal Policy • Hemp • Cannabinoids

Trump Signed a Spending Bill That Functionally Bans Most Hemp THC (Including THCA) Within One Year

A single line in the shutdown-ending spending package rewrites “legal hemp” by capping total THC at 0.4 mg per container, wiping out most hemp-derived THC products on today’s shelves.

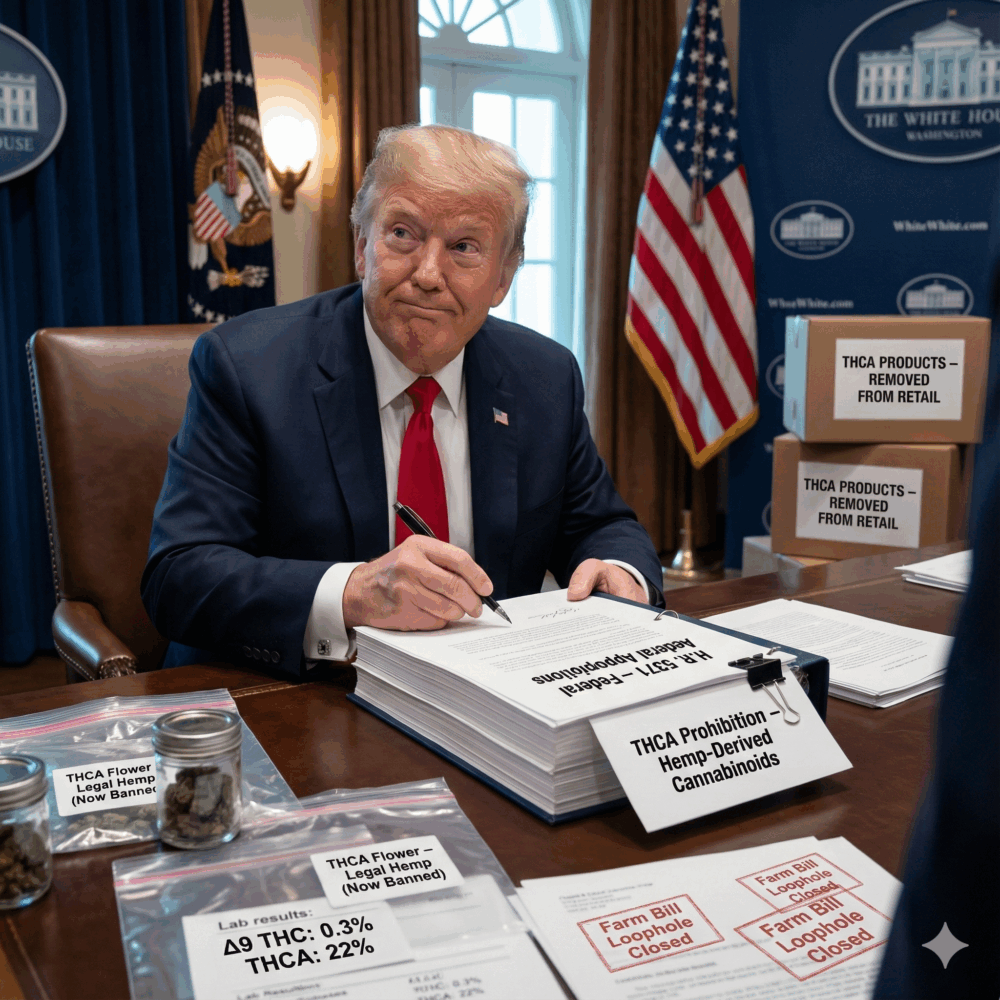

Image: A new federal definition of hemp-derived THC threatens most THCA and hemp THC products.

TL;DR

- A federal spending bill that ended the shutdown includes a provision that effectively bans most hemp-derived THC products.

- Trump signed the package into law on November 12, 2025, starting a 365-day countdown to enforcement. Many reports cite November 12, 2026 as the effective date.

- The key change: hemp products must contain no more than 0.4 milligrams of total THC per container, which wipes out typical gummies, drinks, vapes, tinctures, and THCA products.

- Estimates commonly cited: a ~$28B market and ~300,000 jobs exposed to major disruption.

- The next year becomes a fight over whether Congress replaces a near-ban with a real regulatory framework (testing, labeling, age-gates, licensing).

What just happened

The cannabis and hemp world just got blindsided. In the spending package that ended the shutdown, Congress slipped in language that rewrites the definition of legal hemp-derived cannabinoid products. That single change sets up a near-total wipeout of today’s hemp THC retail market within one year.

Trump signed the bill on November 12, 2025. The provision includes a 365-day implementation window that many outlets describe as putting enforcement around November 12, 2026.

If you sell, ship, manufacture, distribute, or even just rely on hemp-derived THC products, that countdown is the whole story.

The new hemp rule that changes everything

The 2018 Farm Bill focused on concentration: hemp was cannabis with less than 0.3% delta-9 THC by dry weight. That opened the door to a massive market of intoxicating products made from hemp cannabinoids.

The new rule shifts the measurement to an absolute cap: final hemp-derived cannabinoid products are legal only if they contain no more than 0.4 milligrams of total THC per container.

That sounds like a small technical tweak. In reality, it’s a sledgehammer.

Image: The new cap is based on total THC per container, not a percentage.

Why “0.4 mg per container” is basically a ban

Here’s the simple math: most products people actually buy contain far more THC than 0.4 mg in the whole package. A single gummy is commonly several milligrams. A beverage can easily exceed that. A vape cartridge can contain far more.

So even without a headline that says “BAN,” the practical outcome is the same. If the THC in the entire container can’t exceed 0.4 mg, the bulk of the market disappears.

This also means the cap is not just a “dose” issue. It’s a packaging issue. Even if a company tried to cut potency, the cap is so low that it makes normal consumer products non-viable at scale.

What products get hit

The products most likely to be eliminated include:

- THCA flower and concentrates

- Delta-8 and Delta-10 products

- Hemp-derived THC beverages

- Gummies, edibles, chocolates, and candies

- Vapes, tinctures, and sublinguals

Multiple industry reports explicitly flag THCA flower and popular hemp-derived THC categories as being banned or effectively outlawed under the new framework.

Image: The rule hits the most popular product categories first, including THCA.

How we got here

The intoxicating hemp boom grew inside a gap. Federal regulators never built a modern, unified framework for labeling, age limits, potency controls, and testing standards. States did their own thing, enforcement was inconsistent, and the market evolved faster than the rules.

That created predictable backlash: licensed cannabis operators calling it unfair competition, law enforcement and health groups raising safety concerns, and other industries (especially alcohol) watching THC beverages eat into their lane.

The result was a weird coalition that agreed on one thing: stop the current version of hemp THC from expanding.

Economic fallout and who gets hurt first

The estimates floating around are not small. The hemp-derived THC sector is often described as an annual market around $28B, with roughly 300,000 jobs tied to it.

And this is not limited to “online brands.” A lot of hemp THC is sold through mainstream retail, bars, restaurants, gas stations, and convenience stores. Reports out of large states like Texas describe massive exposure in hemp beverages and retail channels.

The first wave of pain usually hits the same places: small retailers sitting on inventory, manufacturers with packaging and raw material commitments, and workers whose jobs exist only because these products move quickly and repeatedly.

What it means for businesses, consumers, and states

For hemp businesses

The clock is the enemy. A one-year runway sounds generous until you look at real-world supply chains: product development, packaging, labeling, compliance testing, wholesale distribution, and cash-flow cycles.

If your revenue is heavy on intoxicating hemp, you need a pivot plan that actually works under the 0.4 mg cap, not just “we’ll adjust potency.”

For regulated cannabis

This removes a major competitor, but it doesn’t automatically convert consumers to dispensaries. Some will, but others will either stop buying or find a replacement market that doesn’t require ID checks, taxes, or testing.

For consumers

This is where the policy gets messy. A huge chunk of people used hemp-derived THC because it was accessible, discreet, and available in places where dispensary access is limited. If those products vanish, demand does not vanish with them.

For states

Even states that built responsible hemp programs can get preempted by federal definitions. That’s part of why the next year is going to be filled with lobbying, proposed fixes, and lawsuits.

The black market risk nobody wants to talk about

If the policy goal is safety, there’s a big potential problem: pushing products underground removes guardrails. No testing. No accurate labeling. No age checks. No recall systems. No tax compliance.

MJBizDaily and other outlets have already framed the coming months as a disruption window, with businesses weighing whether the prohibition is enforceable in practice and what consumers do next.

The most realistic outcome is not “people quit THC.” It’s “people buy THC somewhere else.”

Can this be changed before enforcement

The 365-day window creates a political battleground. We’re already seeing efforts to replace a near-ban with a real regulatory framework that allows products but adds safety rules.

For example, senators have introduced proposals aimed at keeping hemp cannabinoid commerce alive while adding rules and oversight.

Whether any fix survives is going to come down to who has leverage, and who gets blamed if a legal market collapses and an illicit one grows.

What to do right now

- Audit your product portfolio: Identify which SKUs exceed a 0.4 mg total THC per container cap.

- Inventory strategy: Build an actual sell-through plan that matches the enforcement timeline being reported.

- Compliance documentation: Preserve COAs, supplier contracts, labeling proofs, and testing history in one place.

- Join the policy fight: If you want a regulatory framework instead of a wipeout, support the groups pushing for it.

- Customer communication: Be direct about what could disappear and when, without panic or vague promises.

- Pivot realistically: CBD-only, non-intoxicating products, or adjacent categories might be the only clean path for many operators.

This is not a “wait and see” moment. The companies that move early will have the only advantage that matters: time.

Frequently Asked Questions

Did Trump ban THCA?

The spending bill Trump signed rewrote legal hemp product limits in a way that many reports say effectively bans THCA products by capping total THC per container at 0.4 mg.

What is the new legal THC limit for hemp products?

The provision is widely reported as limiting hemp-derived cannabinoid products to 0.4 milligrams of total THC per container.

When does the hemp THC ban start?

The law was signed on November 12, 2025, and multiple reports describe a one-year implementation window, commonly cited as landing around November 12, 2026.

Does this affect CBD products too?

Some legal analysis warns the 0.4 mg cap could impact full-spectrum CBD products depending on THC content per container, even when non-intoxicating.

Are Delta-8 and Delta-10 included?

Yes. Industry reporting and legal summaries consistently flag Delta-8 and Delta-10 as categories that get wiped out by the new framework.

Will this push consumers to the black market?

Many observers argue demand will stay, meaning supply shifts to unregulated channels if legal shelves go empty.

Does this change state-legal marijuana programs?

No. This provision targets hemp-derived cannabinoid products and does not rewrite state adult-use or medical cannabis laws.

Why did Congress do this now?

Reports describe a coalition of interests pushing for a “loophole closure,” including safety concerns, market competition issues, and pressure around THC beverages and youth access.

Is there any chance it gets reversed?

Possibly. The one-year window is fueling proposals for a regulated framework instead of a near-total ban, including bills introduced by senators to keep hemp cannabinoids legal with oversight.

What should hemp brands do right now?

Start with a product audit against the 0.4 mg per-container cap, build a sell-through plan, lock down compliance documentation, and engage with the groups pushing for a regulated alternative framework.